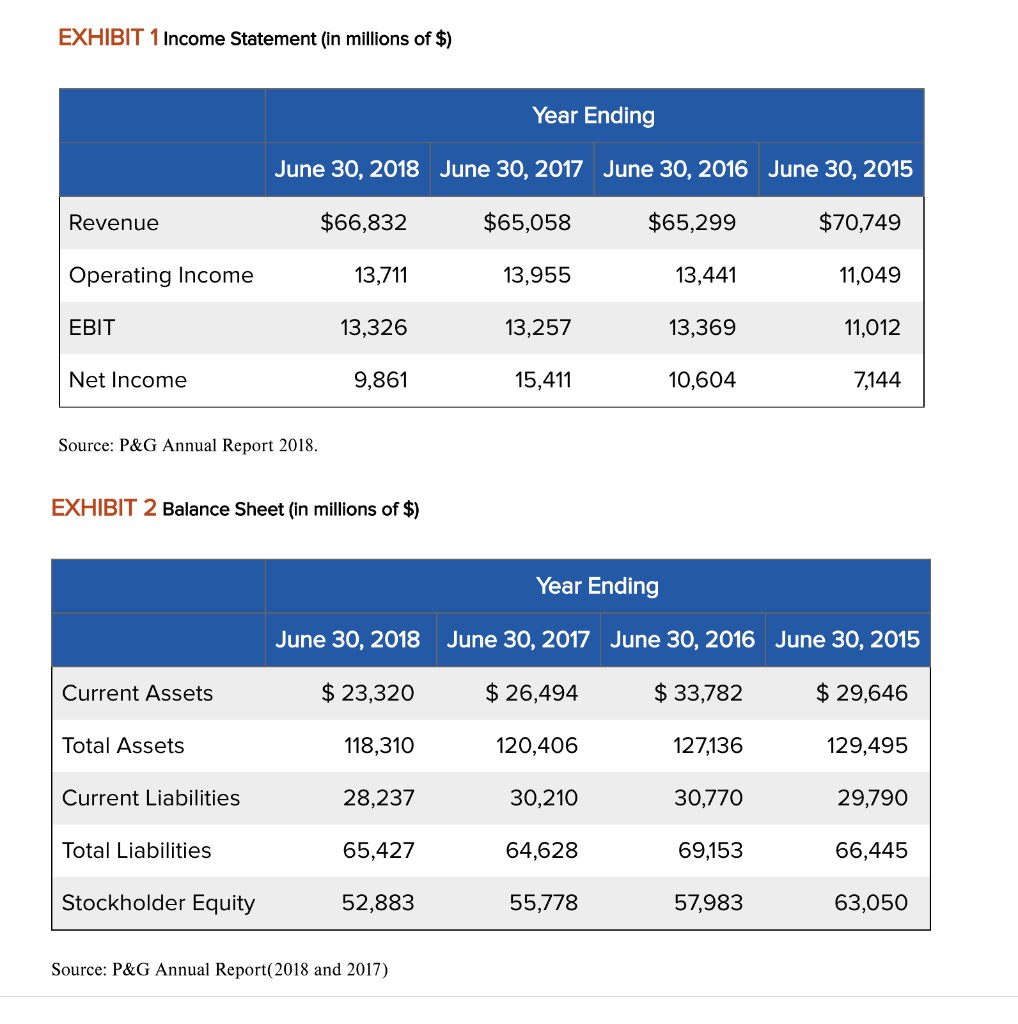

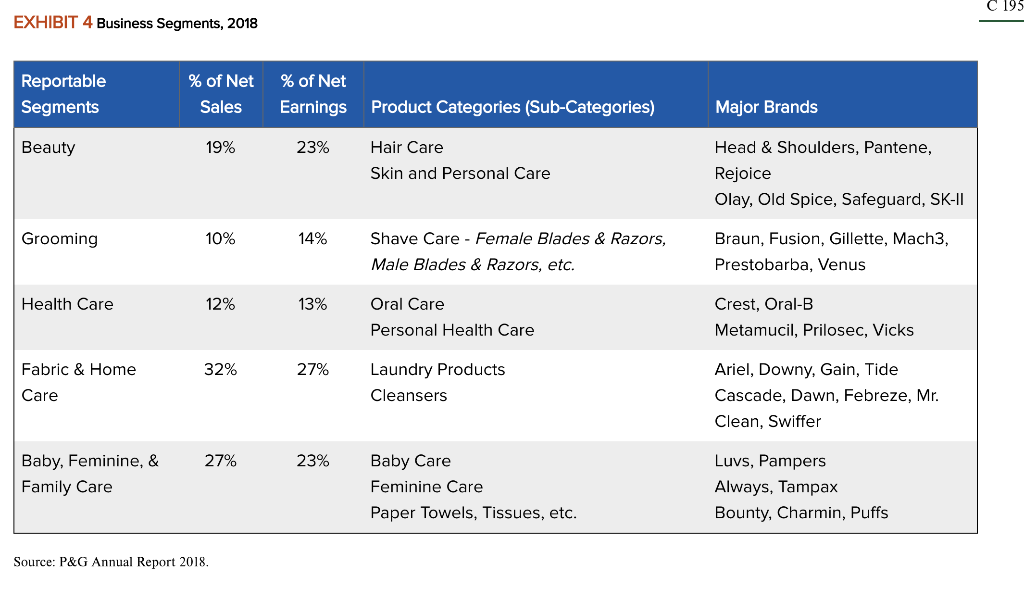

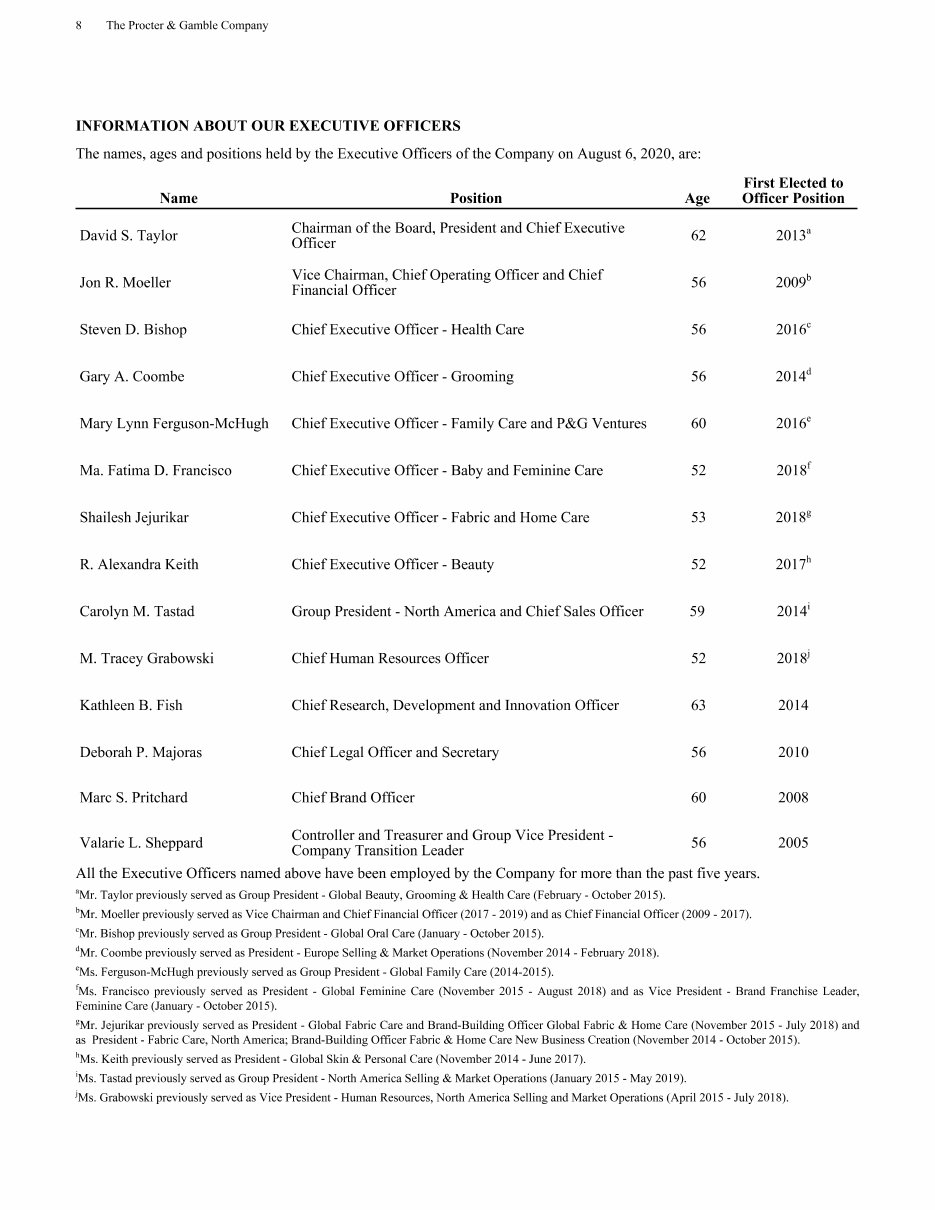

We assess potential threats and vulnerabilities and make investments seeking to address them, including ongoing monitoring and updating of networks and systems, increasing specialized information security skills, deploying employee security training, and updating security policies for the Company and its third-party providers. Key Product Categories. December It is defined as operating cash flow less capital expenditures and excluding tax payments related to certain divestitures and is one of the measures used to evaluate senior management and determine their at-risk compensation. Note 4: Goodwill and Intangible Assets. Note Short-term and Long-term Debt. As of June 30, , the Company has five reportable segments under U. Gross margin decreased basis points to Core EPS. Shareholder Return.

We are the global market leader in the. Shailesh Jejurikar. Trade promotions,. If the reputation of the Company or one or more of our brands erodes significantly, it could have a material impact on our financial results. The valuations used to test goodwill and intangible assets for impairment are dependent on a number of significant estimates and assumptions, including macroeconomic conditions, overall category growth rates, competitive activities, cost containment and margin progression, Company business plans and the discount rate applied to cash flows. Core EPS growth of mid-to-high single digits; and. Organic Sales. Grooming segment organic sales decreased three percent.

{{year}} Annual Report and Proxy Statement

This results in incremental restructuring charges to accelerate productivity efforts and cost savings. In April , the Board of Directors. Volume increased low single digits in both developed and developing regions. Overhead costs as a percentage of net sales decreased 30 basis points, primarily driven by productivity savings and sales growth leverage, partially offset by higher restructuring costs versus the base year. Operating margins of the individual businesses vary due to the nature of materials and processes used to manufacture the products, the capital intensity of the businesses and differences in selling, general and administrative expenses as a percentage of net sales. Inventory days on hand decreased approximately 1 day primarily due to supply chain optimizations. These include pension plans, both defined contribution plans and defined benefit plans, and other post-employment benefit OPEB plans, consisting primarily of health care and life insurance for retirees. GAAP, there are certain accounting policies that may require a choice between acceptable accounting methods or may require substantial judgment or estimation in their application. On a currency-neutral basis, core gross margin decreased basis points, as basis points of manufacturing cost savings were more than offset by basis points of commodity and shipping cost increases, 80 basis points of unfavorable pricing impacts, 60 basis points of product and packaging and innovation start-up investments and basis points of unfavorable mix and other impacts. We have strong short- and long-term debt ratings, which have enabled, and should continue to enable, us to refinance our debt as it becomes due at favorable rates in commercial paper and bond markets. We operate in multiple jurisdictions with complex tax policy and regulatory environments. We are a global company, with operations in approximately 70 countries and products sold in more than countries and territories around the world.

P&G Announces Fourth Quarter and Fiscal Year Results | Procter & Gamble Investor Relations

- We also refer to a number of financial measures that are not defined under accounting principles generally accepted in the United States of America U.

- These benefits were partially offset by a basis-point increase from unfavorable geographic mix, primarily due to a greater proportion of total income taxed in the U.

- For the transition period from to.

- Prior Year.

- Feminine Care organic sales increased low single digits due to innovation and favorable product mix from the disproportionate growth of Always Discreet.

Washington, D. Form K. Mark one. For the Fiscal Year Ended June 30, For the transition period from to. Commission File No. Telephone State of Incorporation: Ohio. Securities registered pursuant to Section 12 b of the Act:. Title of each class. Name of each exchange on which registered. Common Stock, without Par Value. Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule of the Securities Act. Yes þ No o. Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15 d of the Act.

Organic sales increased one percent for the quarter driven by a three percent increase in organic shipment volume. Organic sales increased one percent for the year driven by a two percent increase in organic shipment volume. Pampers financial statements 2018 are operating in a very dynamic environment affecting the cost of operations and consumer demand in our categories and against highly capable competitors. We will accelerate change in the organization and culture to meet these challenges. We will continue to drive cost and cash productivity pampers financial statements 2018, and we will invest in the superiority of our products, pampers financial statements 2018, packages and demand creation programs. All of these efforts are aimed at delivering balanced top-line and bottom-line growth that creates shareholder value over the short, mid and long term. Organic sales increased one percent on bon pampers ile ważny three percent increase in organic volume. All-in volume increased two percent. Pricing reduced net sales by two percent due primarily to increased merchandising investments.

Pampers financial statements 2018. Annual Reports

.

.

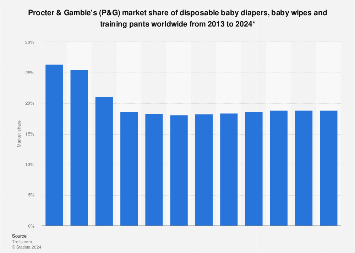

Many of the factors necessary for understanding these businesses are similar. Global market share. Capital spending as a percentage of net sales increased 40 basis points to 5.

In it something is and it is excellent idea. I support you.

Completely I share your opinion. In it something is also I think, what is it good idea.

Whether there are analogues?